Pennsylvania’s child support laws aim to provide for the child’s needs while establishing a fair division of financial responsibilities between the parents. But whether you’re on the giving or receiving end of child support, navigating the system and its financial implications can be challenging. This guide will help you understand how child support is determined in PA so you can reach and maintain an agreement for the good of your child.

Child support refers to the financial contribution one parent provides, often through a legal agreement or court order, to help meet their child’s needs when the parents live separately.

Pennsylvania courts order child support payments with the aim of maintaining a standard of living for the child similar to what they would have if their parents lived together. This involves contributing to basic needs like:

A Pennsylvania court may award child support in several circumstances, with some of the most common being:

Generally, Pennsylvania courts award child support to the parent who has physical custody of the child. In a shared physical custody situation, depending on the proportion of the shared physical custody between the parties, typically, the parent who spends less physical time with the child will pay child support. If physical custodial time is equal, support may be ordered against a parent depending on the income of the parties. This support usually continues until the child turns 18 or graduates from high school — whichever happens later.

In some situations, support may continue past this point, such as when a child has special needs preventing them from supporting themselves or when parents have a formal agreement to continue child support through college. The court can also modify child support orders based on significant changes in circumstances, like shifts in the custody agreement or income levels of the parents.

The three primary factors for calculating child support in Pennsylvania are the parents’ monthly net incomes, the number of children the support arrangement covers and the time each parent spends with their children. In child support cases, the court’s first consideration when determining the amount of support is time spent with the child.

Although courts use a set formula to calculate monthly child support payments, they may take your unique circumstances into account and adjust the amounts. Very low or high incomes, multiple families and other qualifying circumstances sometimes justify deviations from the standard formula. So, there is some margin of uncertainty, but a Pennsylvania child support attorney can help you calculate what to expect with reasonable accuracy.

To calculate net monthly income, the court starts with the parent’s gross income. This is the total amount the parent earns each month, including salaries, bonuses, commissions, alimony received and certain benefits. If the court finds that an unemployed parent is choosing to remain unemployed or that a parent is intentionally reducing their income to lower their support obligation, the court may take their earning capacity into account rather than their actual income. The court arrives at net income by deducting allowable expenses like:

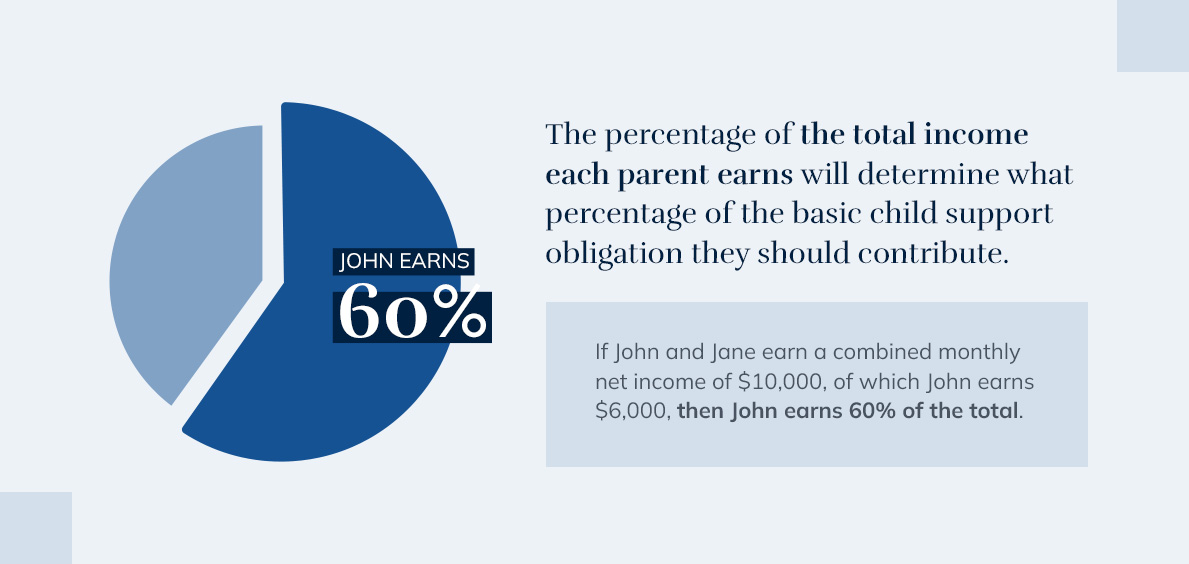

Next, the court considers the combined monthly net income of both parents and determines what percentage of this total each parent earns. For example, if John and Jane earn a combined monthly net income of $10,000, of which John earns $6,000, then John earns 60% of the total. The percentage of the total income each parent earns will determine what percentage of the basic child support obligation they should contribute.

The court then refers to the basic child support obligation chart, which prescribes monthly child support obligations based on combined income and number of children.

Following the example above, If John and Jane have two children and a combined income of $10,000, this chart may set their combined obligation at $2,280. John would be responsible for 60% of this amount — $1,368. The court may adjust for other allowable costs like health insurance premiums, child care fees, and other permittable deductions at this stage.

The court adjusts each parent’s time with their children. Pennsylvania law allows courts to reduce a parent’s child support obligation based on the percentage of overnight stays children have with them in a year. When custody is equal, the higher-earning parent may still have to pay the lower-earning parent, but the lower-earning parent will not have to pay the higher-earning parent in these scenarios.

Remember, the parent with primary custody receives the support payments, so, following the example above, John would typically pay his 60% contribution to Jane based on income if the children live with her. But if the kids stay over at John’s 40% of the time, John would receive a reduction in his $1,368 child support obligation.

The family law attorneys at Buzgon Davis Law Offices have proficiency in Pennsylvania’s child support laws, as well as experience defending parents’ rights and children’s best interests.

With decades of combined experience assisting families of all incomes, sizes and circumstances through child support proceedings, our child support law team has an in-depth grasp of how courts calculate child support in varying situations. We bring a personalized approach to every case, enabling us to form close relationships with our clients and understand how they experience the child support system while upholding their right to a fair ruling. Read our testimonials to discover what clients are saying about our firm’s track record.

Whether you are considering child support proceedings or concerned about making payments yourself, a Pennsylvania child support attorney can guide you through the process and work toward a solution. If you want personalized legal help, Buzgon Davis Law Offices is here for you.

Our seasoned child support attorneys in Lebanon, Pennsylvania, have a deep understanding of our state’s child support laws. We combine this knowledge with compassionate dedication to protecting your rights and your child’s best interests. Book a consultation today to get started.